Blog

Federal Reserve Set to Cut Interest Rates for the First Time in Four Years: Economic Implications and Uncertainties

The Federal Reserve is poised to cut interest rates for the first time in more than four years, marking a significant shift in monetary policy. This decision is aimed at reducing borrowing costs for consumers and businesses, stimulating economic activity, and steering the economy away from a potential downturn.

Background and Context

In recent years, the U.S. economy has faced various challenges, including high inflation and a tight labor market. The Fed has responded to inflation by raising interest rates 11 times in 2022 and 2023, bringing the key rate to a two-decade high of 5.3% (The Independent).

These rate hikes were intended to slow borrowing and spending, ultimately cooling the economy and curbing inflation. However, inflation has since decreased substantially, dropping from a peak of 9.1% in June 2022 to 2.5% recently, which is near the Fed’s target of 2% (The Independent).

The Upcoming Rate Cut

The upcoming rate cut is being carefully watched by investors and economists. The size of the cut is still uncertain, with expectations ranging from a quarter-point to a half-point. A half-point cut would indicate a strong commitment by the Fed to support economic growth, while a quarter-point cut would be more in line with standard policy adjustments(The Independent).

This move is seen as the first in a series of rate cuts that may extend into 2025, as the Fed aims to achieve a “soft landing”—curbing inflation without causing a recession.

Economic Impact

Lowering interest rates generally results in cheaper borrowing costs for mortgages, auto loans, credit cards, and business loans. This can stimulate consumer spending and business investments, potentially leading to job growth and increased economic activity(The Independent).

The reduction in rates is also expected to have an impact on the stock market, as lower rates can make equities more attractive to investors.

The rate cut comes at a time when the U.S. economy is experiencing a slowdown in job growth and a slight increase in unemployment. The job market’s softening has been attributed to an influx of new workers, including recent immigrants and college graduates, rather than widespread layoffs(The Independent).

This situation provides the Fed with some room to maneuver without immediately threatening the labor market.

Uncertainty and Risks

Despite the positive aspects of a rate cut, there are uncertainties and risks associated with this move. The precise size of the rate cut and its timing could have varying effects on the economy. A larger-than-expected cut might signal concerns about the economy’s underlying health, while a smaller cut might not provide sufficient stimulus(The Independent).

Moreover, while the Fed is attempting to lower rates to a neutral level that neither stimulates nor restricts economic growth, determining this level can be challenging.

Conclusion

The Fed’s decision to cut rates for the first time in over four years reflects a shift in focus from combating high inflation to supporting economic growth and stability. While the rate cut is expected to provide a boost to the economy, it is not without its risks and uncertainties. The outcome of this policy shift will depend on how the economy responds to lower borrowing costs and whether the Fed can successfully navigate the complex landscape of monetary policy in a post-pandemic world.

For more detailed information, you can refer to the article from The Independent or Yahoo Finance.

Blog

Morocco Sets Sights on 70% 5G Coverage by 2030 With New License Launch

RABAT — July 26, 2025

In a landmark step toward digital transformation, Morocco’s National Telecommunications Regulatory Agency (ANRT) has officially launched the bidding process for 5G licenses, inviting national and international telecom operators to help deliver 25% population coverage by 2026 and 70% by 2030.

5G Strategy to Power FIFA World Cup and Beyond

The initiative aligns with Morocco’s preparations to co-host the 2030 FIFA World Cup and its broader Maroc Digital 2030 agenda. “This is about more than faster networks—it’s about our national future,” said Driss El Yazami, policy advisor at the Ministry of Digital Transition.

Highlights of the 5G Deployment Plan

- Initial rollouts in Casablanca, Rabat, Marrakech, and Tangier

- Smart infrastructure integration in stadiums and airports

- Spectrum allocation in 3.5GHz and mmWave bands

- Coverage expansion to underserved rural regions

From Urban Startups to Rural Farmers: 5G’s National Reach

5G is expected to revolutionize Moroccan society. Students will gain access to virtual classrooms, remote clinics will offer telemedicine, and farmers can deploy smart sensors. “Connectivity is empowerment,” said Amina El Mahdi, a tech entrepreneur in Fez.

Economic Impact and Cybersecurity Measures

The Ministry of Finance predicts 5G will boost GDP by 1.5% by 2030. All operators must meet strict cybersecurity, data localization, and interoperability standards monitored by ANRT and the National Cybersecurity Directorate.

2030 World Cup: Smart Stadiums and Global Broadcasts

With over 1.5 million visitors expected, 5G will support crowd management, mobile ticketing, HD broadcasts, and fan engagement zones across Moroccan host cities.

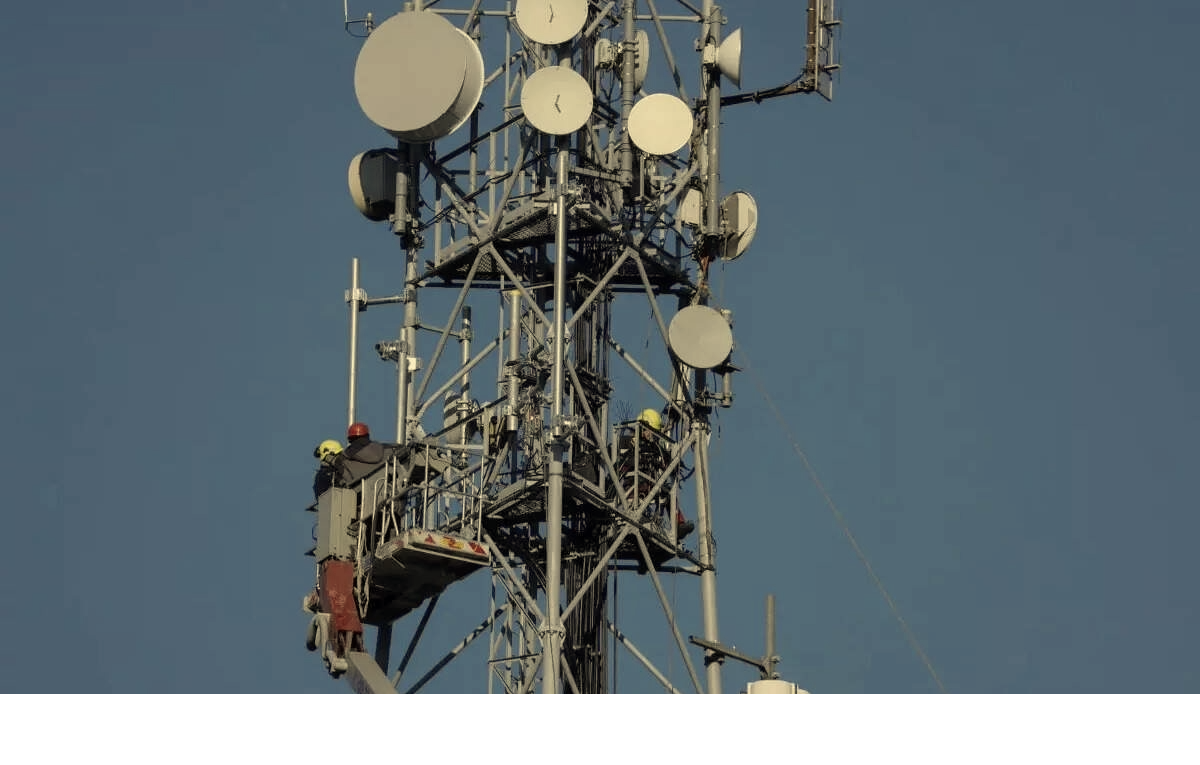

5G infrastructure being deployed in Morocco’s major cities ahead of FIFA 2030.

Blog

Critical Cyber Breach in Tunisia: Government Systems and Banks Hacked, Confidential Data for Sale

A coordinated cyberattack led by Moroccan hacker Jokeir 07x and groups Dark Hell 07x and Dr. Shell 08x compromises key Tunisian institutions, exposing government systems, banking infrastructure, and personal data to global exploitation.

Tunis, July 2025 — In an alarming escalation of cyber threats across North Africa, Tunisia has become the latest victim of a highly organized and devastating cyberattack. Orchestrated by Moroccan threat actor Jokeir 07x, in partnership with the groups Dark Hell 07x and Dr. Shell 08x, the operation has compromised critical national infrastructure—from government domains to private financial institutions.

“This is not just a defacement campaign—it’s full infrastructure penetration,” declared Jokeir 07x on Telegram.

The targets include the Ministry of Finance, Bank of Tunisia, BTK, and the Tunisian Academy of Banking and Finance, among others. The attackers claim full access to internal systems, including emails, financial records, developer platforms, and sensitive citizen data.

🏛️ Government Domain Breached: Ministry of Finance

The domain finances.gov.tn was infiltrated through 16 high-risk subdomains such as auth., gitlab.intra., mail., and login-tej. According to hacker statements, these allowed access to:

- Internal recruitment systems

- Budgetary information

- Developer repositories

- Administrative emails

This level of penetration indicates control over Tunisia’s digital authentication infrastructure and DevOps environment, raising severe concerns for national cybersecurity.

🏦 Banking Sector Compromised and Data Sold

Several banks were also impacted:

- Bank of Tunisia (bt.com.tn):

- Full customer database allegedly available for $4,000

- Individual bank accounts offered at $100

- 5-account bundles sold for $450

- BTK Bank (btknet.com) and Academy of Banking and Finance (abf.tn) also suffered complete breaches, including control over the sites and underlying systems.

The incident signals not just a data breach but the active commercialization of sensitive financial information on the dark web.

🔍 Technical Breakdown: How It Happened

Cybersecurity analysts have pointed to multiple failure points within Tunisia’s digital infrastructure:

- Web Application Vulnerabilities:

- SQL Injection

- File Upload flaws

- XSS

- Remote File Inclusion (RFI)

- SSO and Mail System Exploitation:

- Session hijacking likely

- Weak session/cookie management

- GitLab Exposure:

- Unauthorized access to internal GitLab revealed API tokens, credentials, and system architecture

- Lack of Security Infrastructure:

- No evidence of WAF, IDS, or SIEM defense

- No active monitoring or response systems

- Inadequate Data Protection:

- Absence of encryption, data masking, or tokenization

- Entire banking datasets available in plain text

⚠️ The Fallout: Trust, Security, and Reputation

This attack lays bare the vulnerabilities in Tunisia’s cyber defenses, damaging public trust in both government institutions and the banking sector. The country’s financial and administrative data has now surfaced on international black markets, with potential long-term repercussions for national security and economic stability.

💡 Urgent Recommendations for Recovery and Reform

Cybersecurity professionals are urging Tunisia to immediately:

- Establish internal SOC (Security Operations Centers)

- Mandate routine penetration testing

- Enforce multi-factor authentication (MFA)

- Implement end-to-end data encryption

- Audit and secure GitLab instances

- Conduct staff training on social engineering threats

- Deploy real-time code and data monitoring

“Being hacked is not the shame—failing to learn from it is,” noted a Tunisian cybersecurity analyst. “The future belongs to those who invest in digital resilience, not legacy infrastructure.”

Blog

Cloud Wars 2025: Full Breakdown of Azure, AWS, and Google Cloud Services You Need to Know

As cloud computing reshapes digital infrastructure, this side-by-side comparison of services across Microsoft Azure, Amazon Web Services (AWS), and Google Cloud Platform (GCP) empowers IT professionals and organizations to make informed decisions.

Cloud Wars: Breaking Down the Giants

In today’s digital-first world, cloud computing isn’t just a trend—it’s the backbone of enterprise IT. Whether you’re a startup deploying an app or a global corporation migrating legacy systems, choosing the right cloud provider can make or break your operations. A newly circulated Cloud Services Comparison Cheatsheet provides an invaluable visual breakdown of offerings from Microsoft Azure, Amazon Web Services (AWS), and Google Cloud Platform (GCP), the three dominant players in the cloud arena.

Technical Deep Dive: Key Service Categories Compared

This infographic categorizes over 25 essential cloud services and maps each across Azure, AWS, and GCP equivalents. Here’s what stands out:

1. Compute Services

- Azure: Virtual Machines

- AWS: EC2 (Elastic Compute Cloud)

- Google Cloud: Compute Engine

These services provide scalable virtual server environments, with options for predefined or custom machine types. Azure and AWS offer more mature ecosystems with hybrid cloud integrations, while GCP emphasizes fast boot times and sustained-use discounts.

2. Object Storage

- Azure Blob Storage

- Amazon S3

- Google Cloud Storage

All three services allow you to store large amounts of unstructured data. AWS S3 is known for its advanced features (like S3 Glacier), while Azure Blob integrates well with Microsoft services, and GCP offers multi-regional redundancy by default.

3. Serverless Computing

- Azure Functions

- AWS Lambda

- Google Cloud Functions

Serverless solutions allow developers to execute code without managing servers. AWS Lambda leads in ecosystem maturity, while Azure and Google offer solid integrations with their respective developer tools.

4. Content Delivery Networks (CDNs)

- Azure CDN, AWS CloudFront, and Google Cloud CDN

All three platforms offer global distribution of content to reduce latency. AWS CloudFront is widely adopted in large-scale enterprise environments, while Google leverages its backbone network to deliver high-speed content.

Security & Identity Management

Cloud security remains a priority as data breaches and compliance requirements escalate.

- Identity and Access Management (IAM) is offered across platforms with Azure Active Directory, AWS IAM, and Google Cloud IAM.

- Key Management Services (KMS) ensure secure handling of encryption keys across all three.

- Compliance tools like Azure Trust Center, AWS Cloud HSM, and Google Cloud Security help enterprises adhere to global regulations like GDPR, HIPAA, and ISO/IEC.

Specialized Services: AI, Containers, and Analytics

- Analytics: Azure Stream Analytics, Amazon Kinesis, and Google Dataflow enable real-time data processing.

- Containers: Azure Kubernetes Service (AKS), Amazon EKS, and Google Kubernetes Engine (GKE) support modern container orchestration.

- Automation: Each provider supports automation—Azure with Azure Automation, AWS with OpsWorks, and GCP with Deployment Manager.

Notable Differences

Some categories reveal gaps:

- Google Cloud lacks direct equivalents for services like DNS management (Route 53, Azure DNS) or cloud notifications (AWS SNS, Azure Notification Hub).

- Azure leads in hybrid cloud features due to its integration with Windows Server and on-prem tools.

- AWS offers the broadest service portfolio, making it ideal for complex multi-cloud or global enterprise setups.