business

Fintech Industry Faces Crisis Amid Privacy, Security, and Regulatory Challenges

The fintech industry, once heralded as the vanguard of financial innovation, is navigating a turbulent period characterized by escalating cybersecurity threats, regulatory scrutiny, and evolving market dynamics. These challenges are prompting a critical reevaluation of business models, data practices, and strategic priorities within the sector.

Data Privacy: A Double-Edged Sword

As fintech companies increasingly rely on customer transaction data for monetization, concerns over privacy and trust have taken center stage. Many firms anonymize and sell data to advertisers, leveraging insights to generate revenue. However, consumer awareness about the use of their financial data has grown, leading to debates about transparency and informed consent.

Regulatory responses vary globally, with regions such as the European Union imposing strict data protection laws like GDPR, while others lag behind in safeguarding sensitive information. Striking a balance between data monetization and privacy remains a pressing challenge for the industry.

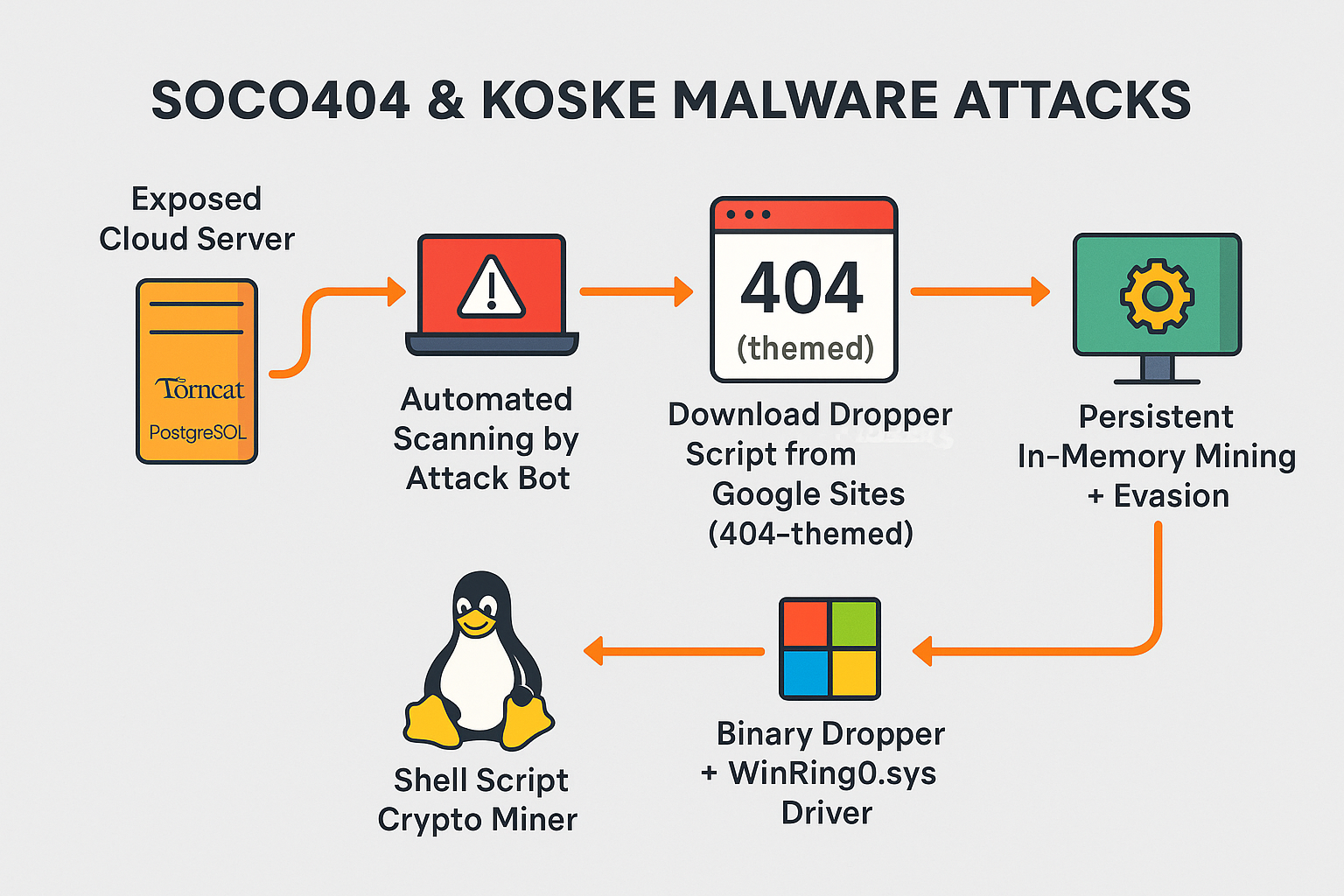

Cybersecurity Threats Highlight Vulnerabilities

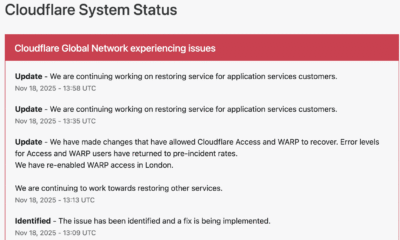

The sector’s rapid expansion has made it a prime target for cyberattacks. In October 2024, Finastra, a major fintech firm, disclosed a breach in one of its secure file-transfer platforms, compromising data from several large financial institutions. The attack went undetected for over a week, underscoring the vulnerabilities inherent in fintech infrastructures.

Such incidents emphasize the need for enhanced security measures and robust incident response strategies to protect sensitive financial data and maintain trust among customers and partners.

Regulatory Pressures Mount

Regulatory scrutiny of fintech companies has intensified, focusing on compliance and consumer protection. The Federal Trade Commission (FTC) recently filed lawsuits against firms like Dave, alleging deceptive practices around cash advances and hidden fees.

These legal actions highlight the importance of transparent operations and adherence to financial regulations. Companies that fail to comply risk not only financial penalties but also reputational damage in an increasingly competitive market.

Market Volatility and Investor Uncertainty

Market conditions remain volatile, impacting investor confidence in fintech ventures. Cryptocurrency values, a significant component of the fintech ecosystem, continue to fluctuate, contributing to uncertainty.

Despite these challenges, some companies, such as Klarna, are preparing for initial public offerings (IPOs), aiming to capitalize on renewed investor interest. However, the success of such efforts depends on broader economic trends and the industry’s ability to address existing weaknesses.

Strategic Shifts to Navigate Turbulence

In response to these challenges, many fintech firms are adopting strategic shifts. Embracing regulatory frameworks has become a priority for major cryptocurrency platforms, which seek to legitimize their operations and mitigate risks. These efforts reflect a broader alignment with traditional financial systems while preserving innovation and customer engagement.

Additionally, companies are investing in advanced cybersecurity measures, prioritizing transparency, and exploring partnerships with traditional financial institutions to bolster credibility and operational resilience.

The Path Forward

The fintech industry is at a crossroads, facing critical decisions that will shape its future. Addressing issues related to data privacy, security, and regulatory compliance is paramount to maintaining consumer trust and ensuring sustainable growth. While the challenges are significant, the sector’s resilience and capacity for innovation provide a foundation for recovery and advancement.

As fintech adapts to these pressures, its ability to navigate the complexities of modern financial ecosystems will determine its role in shaping the future of global finance.

business

Verizon Slashes Jobs in Record-Breaking Layoff — Here’s What We Know

Verizon announced a sweeping workforce reduction that will affect “more than” 13,000 employees — roughly 13% of its global headcount — in what CEO Dan Schulman calls the company’s largest-ever layoff. In an internal memo, Schulman says the move is intended to “simplify our operations to address the complexity and friction that slow us down and frustrate our customers.” The company also plans to cut outsourced and outside labor costs significantly. U.S.-based staff will begin receiving notifications today; employees outside the U.S. will be informed in the “coming weeks,” the Wall Street Journal reports

What Verizon says

- Reason: operational simplification and removing friction that hurts customer experience.

- Scale: “more than” 13,000 roles, about 13% of the workforce.

- Outsourcing: a significant reduction in outsourced and outside labor spending is part of the plan.

- Timing: U.S. notifications begin immediately; international notifications will follow.

Immediate impact

- Employees: tens of thousands will be affected directly or indirectly. U.S. notifications beginning today means many workers will learn their status immediately.

- Operations: Verizon says the goal is to reduce complexity and improve service — but short-term disruption to teams and projects is possible as roles are consolidated.

- Customers: Verizon frames the change as a way to speed decision-making and improve customer experience, though execution risk exists during the transition.

- Outsourced partners: vendors and contract workers can expect renegotiation or reductions.

What affected employees should do now

- Check official communications from HR and your manager for next steps and severance details.

- Ask about outplacement support (resume help, job counseling) and whether the company offers extended healthcare, COBRA assistance, or phased transitions.

- Document your work (accomplishments, repos, access) and secure personal copies of non-sensitive materials.

- File for unemployment as soon as possible where eligible and update LinkedIn and your network.

- Use company resources (employee assistance programs, career centers) and local talent services.

What managers and the company should prioritize

- Clear, compassionate communications and FAQs for affected employees.

- Fast, transparent explanation of severance, benefits continuation, and outplacement services.

- Careful workload redistribution and project continuity plans to avoid customer impact.

- A public-facing message to reassure customers and investors about service continuity and long-term strategy.

Market and strategic context (what this implies)

- Verizon is attempting aggressive cost reduction while refocusing on product and service quality (e.g., 5G, fixed wireless, enterprise services).

- Cutting outsourced labor and internal layers can reduce costs but carries execution risk: lost institutional knowledge, lowered morale, and short-term productivity dips.

- Investors may welcome lower operating expenses; customers and regulators will watch for service degradation.

business

🇲🇦 King Mohammed VI’s Speech Sparks Heated Debate in Parliament — “جيل زد يُجيب”

Rabat — October 2025

Inside Morocco’s Parliament, tension and reflection filled the air just hours after His Majesty King Mohammed VI delivered his opening-session speech. What was meant as a national roadmap quickly turned into a day of open confrontation, emotional testimonies, and unexpected admissions from members of both majority and opposition blocs.

🏛️ A Speech That Touched Nerves

The King’s address, described by analysts as “direct and reform-oriented,” called for greater social justice, job creation, and balanced development across Morocco’s regions.

“No village left forgotten, no coast without a hand,” the King declared — a message that resonated deeply with citizens and lawmakers alike.

Within hours, parliamentary corridors buzzed with interviews, arguments, and introspection. Some MPs hailed the speech as “a moral reset,” while others questioned whether the government was capable of turning royal vision into tangible results.

🧠 From Rabat to the Sahara — Gen Z Responds

Younger members of Parliament — labeled as جيل زد (Gen Z) — became the focus of cameras and public curiosity. Many expressed frustration at what they see as a widening gap between political promises and everyday realities faced by Moroccan youth.

“The King spoke about unity and work. We agree — but the youth need a chance to prove themselves,” said one 28-year-old deputy.

“We have the energy; the system just needs to open its doors.”

Another young MP caused a social-media storm after saying that “in some ways, Moroccan social values are stronger than Germany’s.”

Critics accused him of downplaying Europe’s economic strength, while others applauded his pride in Moroccan family cohesion.

He later clarified his words, emphasizing that every nation faces challenges — and that Morocco’s real wealth lies in its people.

💬 Resignation, Reflection, and Responsibility

Just a week earlier, one deputy had submitted his resignation in protest over what he called “a lack of listening to the new generation.”

After the King’s address, he withdrew it.

“The royal speech gave me renewed hope. This is not the time to quit — it’s time to work,” he told reporters.

Across party lines, both RNI and PAM youth wings echoed similar messages: commitment to reform, but also impatience with bureaucracy.

Several MPs criticized ministers who, they said, “do not answer calls, do not reply to written questions, and have lost touch with citizens.”

⚖️ Opposition Voices: ‘A Government in Denial’

Members of the opposition used the session to accuse the cabinet of denial and poor communication, arguing that ministers are “living in a different reality” from citizens struggling with prices and unemployment.

“The royal messages were clear,” said one opposition leader. “The problem is not the King’s vision — it’s implementation.”

🌍 Morocco’s Path Forward

Analysts note that the King’s address aligned with long-standing themes: national cohesion, balanced territorial development, and respect for dignity in public service.

But the 2025 context — economic pressure, youth disillusionment, and the digital activism of Gen Z — gives these calls new urgency.

“This generation communicates differently,” said a policy researcher. “If institutions don’t adapt, they’ll lose credibility.”

🕊️ A Message Beyond Politics

As the parliamentary session ended, one young MP summed up the mood:

“الملك تكلّم… ونحن سنُجيب بالعمل — The King spoke, and we will answer through action.”

For now, the chamber that often echoes with partisan debates found itself united — briefly — under a single message:

Morocco’s future belongs to its youth, but responsibility belongs to everyone.

business

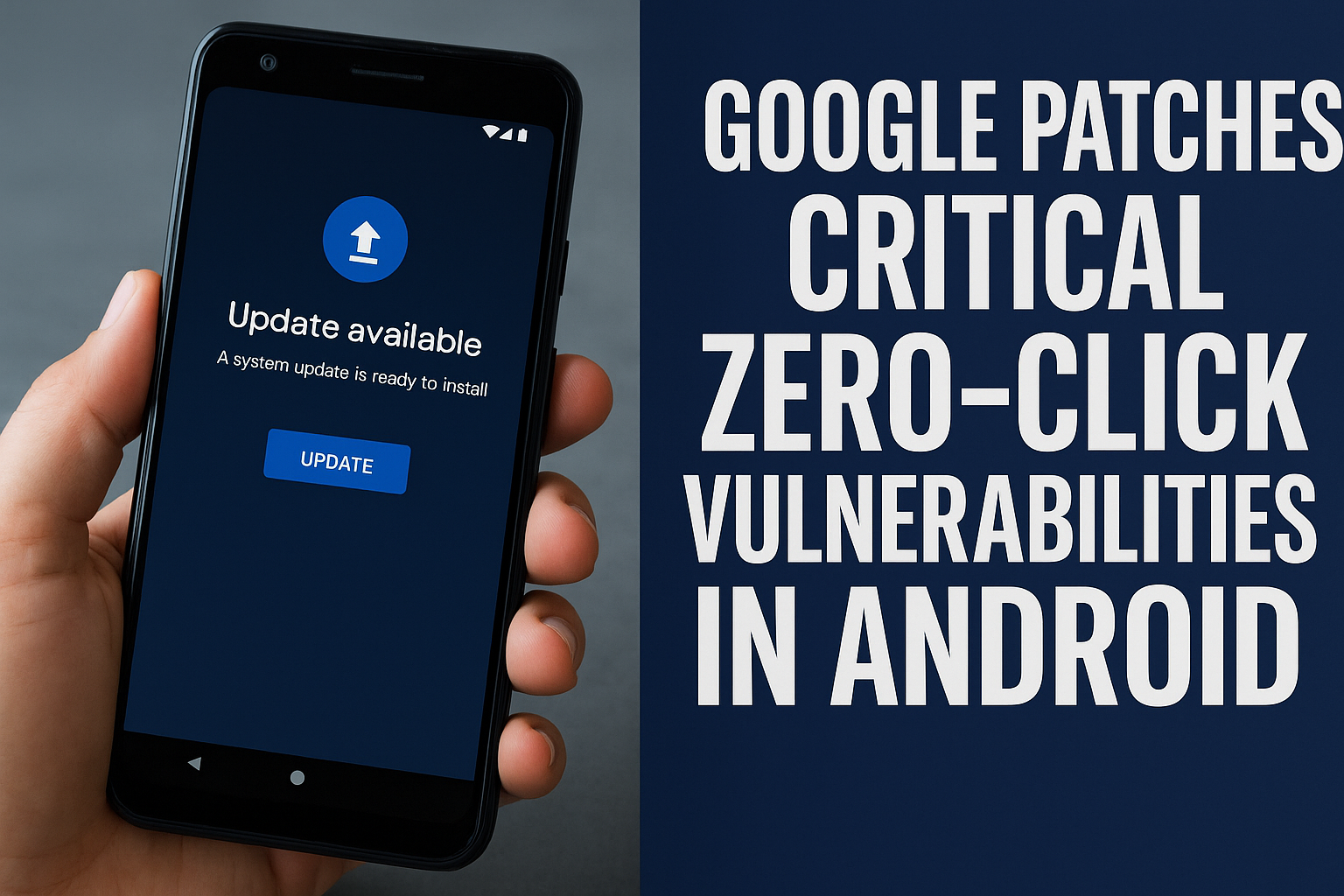

Luxury Carmaker Jaguar Land Rover Shuts IT Systems After Cyberattack

Tata Motors’ luxury brand shuts global IT systems amid suspected ransomware attack; no customer data reported compromised.

Jaguar Land Rover has shut down production and retail systems worldwide after a cyberattack “severely disrupted” operations. A hacking group linked to previous attacks on UK retailers has claimed responsibility. While no customer data appears compromised, the incident halted vehicle registrations and manufacturing, raising fresh alarms about the auto industry’s vulnerability to cyber threats

Jaguar Land Rover Hit by Major Cyberattack

Jaguar Land Rover’s global production and retail operations were brought to a standstill this week after a cyberattack “severely disrupted” its IT systems. The company shut down core applications and suspended manufacturing across key UK plants, including Halewood and Solihull, during one of the busiest sales periods of the year.

The UK’s National Crime Agency has opened an investigation, while the company races to restore operations. JLR confirmed that, as of now, there is no evidence that customer data has been compromise

Immediate Disruption to Plants and Dealers

The September 2 cyber incident forced JLR, owned by India’s Tata Motors, to halt assembly lines, send staff home, and suspend dealer systems used to register new vehicles. Dealers reported they could sell in-stock cars but could not process new registrations, delaying deliveries and revenue flows.

A company spokesperson said:

“We took immediate action to mitigate its impact by proactively shutting down our systems. We are now working at pace to restart our global applications in a controlled manner.”

Expert Reactions

Cybersecurity specialists warn the incident highlights the fragility of digitally integrated manufacturing.

Dray Agha, Senior Manager at Huntress, said:

“This incident highlights the critical vulnerability of modern manufacturing, where a single IT system attack can halt a multi-billion-pound physical production line.”

Aiden Sinnott, a researcher at Sophos, compared the attackers’ tactics to those of notorious cyber gangs:

“They speak English and they are keen on using social media channels. Lapsus$ shared similar tactics and demographics as the Scattered Spider collective.”

Technical Analysis

While JLR has not disclosed the specific intrusion method, several indicators suggest ransomware-style tactics:

- Proactive Shutdowns: JLR’s decision to disable IT and OT (operational technology) systems aligns with standard ransomware containment measures.

- Interconnected Impact: The attack disrupted not just IT but entire supply chains, underscoring the risks of tightly linked digital production networks.

- Extortion Motive Likely: Although no ransom demand has been confirmed, past incidents involving JLR and similar industries suggest data exfiltration and extortion are possible.

The incident underscores the importance of segmentation, real-time monitoring, and robust incident response across manufacturing IT and OT systems.

Impact and Response

- Employees: Factory staff in the UK were sent home as assembly lines stopped.

- Dealers & Customers: Dealers could not register new vehicles, delaying customer deliveries.

- Suppliers: Supply chains faced ripple effects, with halted orders and logistics disruptions.

JLR has engaged external cybersecurity teams and is working with government agencies to restore operations in stages. The company must also prepare for regulatory inquiries and possible long-term trust issues with suppliers and consumers.

Broader Context

The cyberattack comes amid a surge in UK corporate cyber incidents. Retailers including Marks & Spencer, Co-op, and Harrods have all suffered breaches in recent months.

For JLR, this is the second major attack in 2025, following a March breach where a ransomware group claimed to have stolen internal data. The company had invested heavily in cybersecurity modernization, including a contract with Tata Consultancy Services—but repeated incidents suggest lingering vulnerabilities.

Conclusion

Jaguar Land Rover’s shutdown highlights the growing risks of interconnected, digital-first manufacturing. In today’s auto industry, downtime no longer means a local setback—it translates directly into lost global revenue and potential long-term reputational harm.

As JLR works to restore its systems, the incident serves as a stark reminder: in modern manufacturing, operational resilience depends as much on cybersecurity as on engineering.

Sources:

Reuters, Britain’s JLR hit by cyber incident that disrupts production, sales;

The Guardian, Hackers linked to M&S breach claim responsibility for Jaguar Land Rover cyber-attack;

Financial Times, Jaguar Land Rover says production ‘severely’ disrupted by cyber incident;

SecurityWeek, Jaguar Land Rover Operations Severely Disrupted by Cyberattack.