data breaches

Finastra Data Breach: 400GB of Sensitive Client Data Exposed and Sold on Dark Web

November 22, 2024 – In a shocking development, financial software giant Finastra has fallen victim to a massive data breach, exposing approximately 400GB of highly sensitive client data. The stolen information, reportedly being sold on the dark web, includes confidential financial records, personal client details, and proprietary business information, raising significant concerns about cybersecurity within the financial technology sector.

Details of the Breach

The breach was first uncovered by cybersecurity researchers monitoring dark web marketplaces. Initial investigations suggest that the attackers infiltrated Finastra’s systems through a sophisticated phishing campaign, exploiting a vulnerability in their cloud infrastructure. The compromised data includes:

- Financial records of clients, including transaction histories and loan agreements.

- Personally identifiable information (PII) such as names, addresses, Social Security numbers, and banking details.

- Proprietary software development and architectural documents.

The attackers are believed to have listed the data for sale on a prominent dark web marketplace, with bidding allegedly reaching six-figure sums.

Impacted Clients and Industries

Finastra serves over 8,500 customers globally, including banks, credit unions, and other financial institutions. The breach has sparked immediate concerns among these clients about potential financial fraud, identity theft, and regulatory repercussions.

One client, a mid-sized European bank, expressed alarm over the breach’s scope:

“The exposure of our sensitive data poses a significant threat to our operations and our clients’ trust,” said the bank’s Chief Information Officer.

Company Response

Finastra has confirmed the breach and issued a statement acknowledging the severity of the situation:

“We are working closely with cybersecurity experts and law enforcement agencies to investigate this incident. Protecting our clients’ data is our top priority, and we are taking all necessary measures to mitigate the impact of this breach,” the company said.

The firm has also initiated a system-wide security review, implemented stricter access controls, and offered affected clients complimentary identity protection services.

Regulatory and Legal Implications

The breach has drawn scrutiny from regulatory bodies across jurisdictions, with several organizations initiating inquiries into Finastra’s compliance with data protection laws, including the European Union’s General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA).

Legal experts predict that the company could face significant penalties if found negligent in safeguarding client data. Potential class-action lawsuits from impacted clients are also on the horizon.

Wider Implications for the Fintech Industry

This incident underscores the increasing vulnerabilities within the fintech sector, which has become a prime target for cybercriminals due to its vast troves of sensitive financial data. Experts are urging companies to adopt more robust cybersecurity measures, such as advanced threat detection systems, employee training programs, and rigorous third-party risk assessments.

“This breach serves as a stark reminder that even industry leaders are not immune to sophisticated cyberattacks. The fintech sector must prioritize cybersecurity as a critical component of its business strategy,” said Dr. Elena Morgan, a cybersecurity analyst.

What’s Next?

As the investigation continues, affected clients are advised to:

- Monitor financial accounts for suspicious activity.

- Immediately update security protocols, including passwords and authentication methods.

- Consider seeking professional cybersecurity consultation to assess potential risks.

Finastra’s breach is a wake-up call for the financial technology industry, emphasizing the need for continuous vigilance in the face of evolving cyber threats.

data breaches

Cloudflare Outage Disrupts Global Internet — Company Restores Services After Major Traffic Spike

November 18, 2025 — MAG212NEWS

A significant outage at Cloudflare, one of the world’s leading internet infrastructure providers, caused widespread disruptions across major websites and online services on Tuesday. The incident, which began mid-morning GMT, temporarily affected access to platforms including ChatGPT, X (formerly Twitter), and numerous business, government, and educational services that rely on Cloudflare’s network.

According to Cloudflare, the outage was triggered by a sudden spike in “unusual traffic” flowing into one of its core services. The surge caused internal components to return 500-series error messages, leaving users unable to access services across regions in Europe, the Middle East, Asia, and North America.

Impact Across the Web

Because Cloudflare provides DNS, CDN, DDoS mitigation, and security services for millions of domains — powering an estimated 20% of global web traffic — the outage had swift and wide-reaching effects.

Users reported:

- Website loading failures

- “Internal Server Error” and “Bad Gateway” messages

- Slowdowns on major social platforms

- Inaccessibility of online tools, APIs, and third-party authentication services

The outage also briefly disrupted Cloudflare’s own customer-support portal, highlighting the interconnected nature of the company’s service ecosystem.

Cloudflare’s Response and Restoration

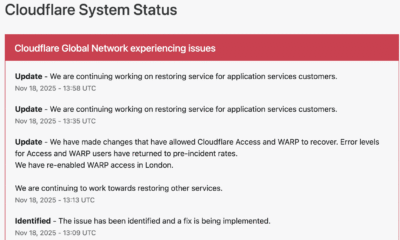

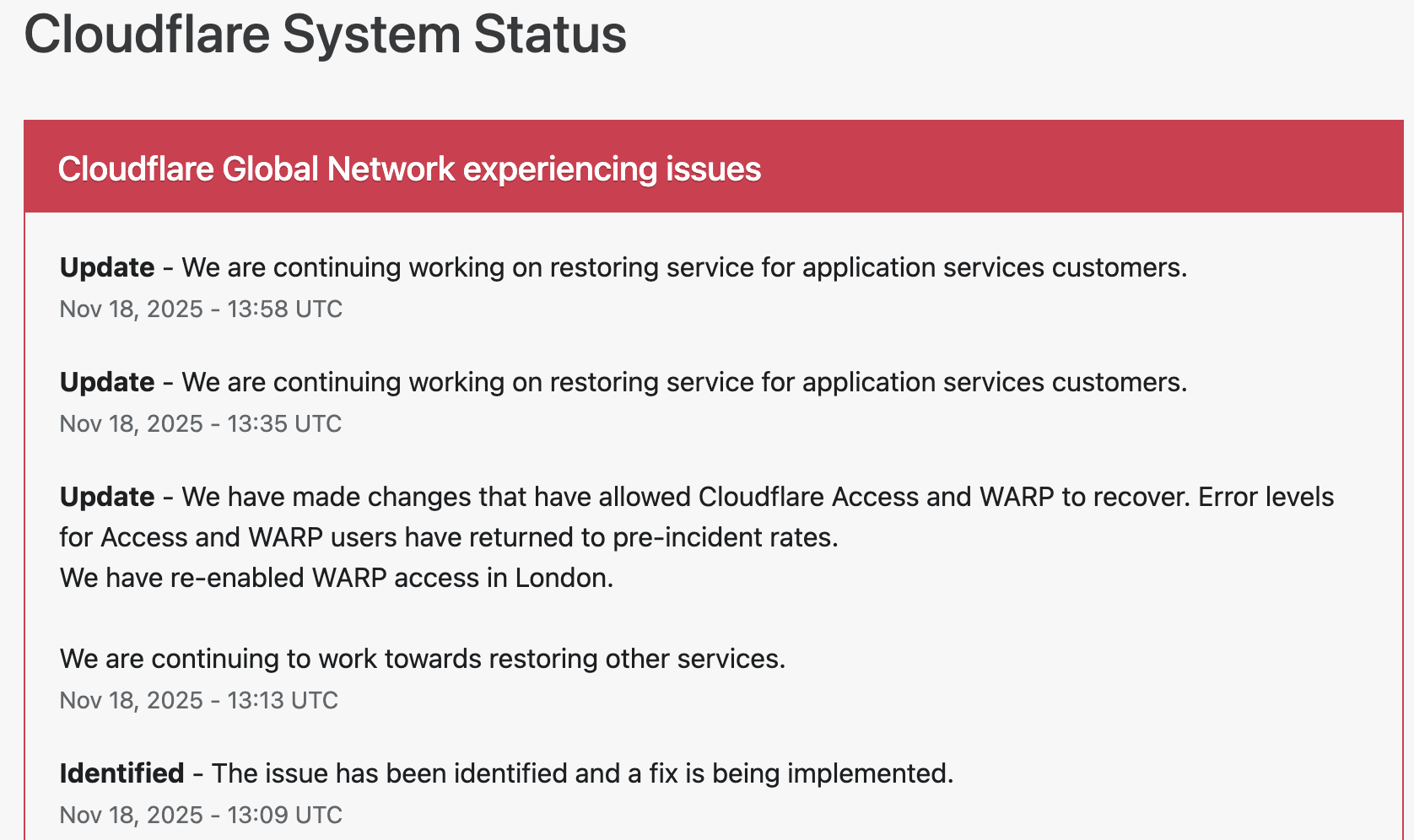

Cloudflare responded within minutes, publishing updates on its official status page and confirming that engineering teams were investigating the anomaly.

The company took the following steps to restore operations:

1. Rapid Detection and Acknowledgement

Cloudflare engineers identified elevated error rates tied to an internal service degradation. Public communications were issued to confirm the outage and reassure customers.

2. Isolating the Affected Systems

To contain the disruption, Cloudflare temporarily disabled or modified specific services in impacted regions. Notably, the company deactivated its WARP secure-connection service for users in London to stabilize network behavior while the fix was deployed.

3. Implementing Targeted Fixes

Technical teams rolled out configuration changes to Cloudflare Access and WARP, which successfully reduced error rates and restored normal traffic flow. Services were gradually re-enabled once systems were verified stable.

4. Ongoing Root-Cause Investigation

While the unusual-traffic spike remains the confirmed trigger, Cloudflare stated that a full internal analysis is underway to determine the exact source and prevent a recurrence.

By early afternoon UTC, Cloudflare confirmed that systems had returned to pre-incident performance levels, and affected services worldwide began functioning normally.

Why This Matters

Tuesday’s outage underscores a critical truth about modern internet architecture: a handful of infrastructure companies underpin a massive portion of global online activity. When one of them experiences instability — even briefly — the ripple effects are immediate and worldwide.

For businesses, schools, governments, and content creators, the incident is a reminder of the importance of:

- Redundant DNS/CDN providers

- Disaster-recovery and failover plans

- Clear communication protocols during service outages

- Vendor-dependency risk assessments

Cloudflare emphasized that no evidence currently points to a cyberattack, though the nature of the traffic spike remains under investigation.

Looking Ahead

As Cloudflare completes its post-incident review, the company is expected to provide a detailed breakdown of the technical root cause and outline steps to harden its infrastructure. Given Cloudflare’s central role in global internet stability, analysts say the findings will be watched closely by governments, cybersecurity professionals, and enterprise clients.

For now, services are restored — but the outage serves as a powerful reminder of how interconnected and vulnerable the global web can be.

data breaches

Cloudflare Outage Analysis: Systemic Failure in Edge Challenge Mechanism Halts Global Traffic

SAN FRANCISCO, CA — A widespread disruption across major internet services, including AI platform ChatGPT and social media giant X (formerly Twitter), has drawn critical attention to the stability of core internet infrastructure. The cause traces back to a major service degradation at Cloudflare, the dominant content delivery network (CDN) and DDoS mitigation provider. Users attempting to access affected sites were met with an opaque, yet telling, error message: “Please unblock challenges.cloudflare.com to proceed.”

This incident was not a simple server crash but a systemic failure within the crucial Web Application Firewall (WAF) and bot management pipeline, resulting in a cascade of HTTP 5xx errors that effectively severed client-server connections for legitimate users.

The Mechanism of Failure: challenges.cloudflare.com

The error message observed globally points directly to a malfunction in Cloudflare’s automated challenge system. The subdomain challenges.cloudflare.com is central to the company’s security and bot defense strategy, acting as an intermediate validation step for traffic suspected of being malicious (bots, scrapers, or DDoS attacks).

This validation typically involves:

- Browser Integrity Check (BIC): A non-invasive test ensuring the client browser is legitimate.

- Managed Challenge: A dynamic, non-interactive proof-of-work check.

- Interactive Challenge (CAPTCHA): A final, user-facing verification mechanism.

In a healthy system, a user passing through Cloudflare’s edge network is either immediately granted access or temporarily routed to this challenge page for verification.

During the outage, however, the Challenge Logic itself appears to have failed at the edge of Cloudflare’s network. When the system was invoked (likely due to high load or a misconfiguration), the expected security response—a functional challenge page—returned an internal server error (a 500-level status code). This meant:

- The Request Loop: Legitimate traffic was correctly flagged for a challenge, but the server hosting the challenge mechanism failed to process or render the page correctly.

- The

HTTP 500Cascade: Instead of displaying the challenge, the Cloudflare edge server returned a “500 Internal Server Error” to the client, sometimes obfuscated by the text prompt to “unblock” the challenges domain. This effectively created a dead end, blocking authenticated users from proceeding to the origin server (e.g., OpenAI’s backend for ChatGPT).

Technical Impact on Global Services

The fallout underscored the concentration risk inherent in modern web architecture. As a reverse proxy, Cloudflare sits between the end-user and the origin server for a vast percentage of the internet.

For services like ChatGPT, which rely heavily on fast, secure, and authenticated API calls and constant data exchange, the WAF failure introduced severe latency and outright connection refusal. A failure in Cloudflare’s global network meant that fundamental features such as DNS resolution, TLS termination, and request routing were compromised, leading to:

- API Timeouts: Applications utilizing Cloudflare’s API for configuration or deployment experienced critical failures.

- Widespread Service Degradation: The systemic 5xx errors at the L7 (Application Layer) caused services to appear “down,” even if the underlying compute resources and databases of the origin servers remained fully operational.

Cloudflare’s official status updates confirmed they were investigating an issue impacting “multiple customers: Widespread 500 errors, Cloudflare Dashboard and API also failing.” While the exact trigger was later traced to an internal platform issue (in some historical Cloudflare incidents, this has been a BGP routing error or a misconfigured firewall rule pushed globally), the user-facing symptom highlighted the fragility of relying on a single third-party for security and content delivery on a global scale.

Mitigation and the Single Point of Failure

While Cloudflare teams worked to roll back configuration changes and isolate the fault domain, the incident renews discussion on the “single point of failure” doctrine. When a critical intermediary layer—responsible for security, routing, and caching—experiences a core logic failure, the entire digital economy resting on it is exposed.

Engineers and site reliability teams are now expected to further scrutinize multi-CDN and multi-cloud strategies, ensuring that critical application traffic paths are not entirely dependent on a single third-party’s edge infrastructure, a practice often challenging due to cost and operational complexity. The “unblock challenges” error serves as a stark reminder of the technical chasm between a user’s browser and the complex, interconnected security apparatus that underpins the modern web.

data breaches

Manufacturing Software at Risk from CVE-2025-5086 Exploit

Dassault Systèmes patches severe vulnerability in Apriso manufacturing software that could let attackers bypass authentication and compromise factories worldwide.

A newly disclosed flaw, tracked as CVE-2025-5086, poses a major security risk to manufacturers using Dassault Systèmes’ DELMIA Apriso platform. The bug could allow unauthenticated attackers to seize control of production environments, prompting urgent patching from the vendor and warnings from cybersecurity experts.

A critical vulnerability in DELMIA Apriso, a manufacturing execution system used by global industries, could let hackers bypass authentication and gain full access to sensitive production data, according to a security advisory published this week.

Dassault Systèmes confirmed the flaw, designated CVE-2025-5086, affects multiple versions of Apriso and scored 9.8 on the CVSS scale, placing it in the “critical” category. Researchers said the issue stems from improper authentication handling that allows remote attackers to execute privileged actions without valid credentials.

The company has released security updates and urged immediate deployment, warning that unpatched systems could become prime targets for industrial espionage or sabotage. The flaw is particularly alarming because Apriso integrates with enterprise resource planning (ERP), supply chain, and industrial control systems, giving attackers a potential foothold in critical infrastructure.

- “This is the kind of vulnerability that keeps CISOs awake at night,” said Maria Lopez, industrial cybersecurity analyst at Kaspersky ICS CERT. “If exploited, it could shut down production lines or manipulate output, creating enormous financial and safety risks.”

- “Manufacturing software has historically lagged behind IT security practices, making these flaws highly attractive to threat actors,” noted James Patel, senior researcher at SANS Institute.

- El Mostafa Ouchen, cybersecurity author, told MAG212News: “This case shows why manufacturing execution systems must adopt zero-trust principles. Attackers know that compromising production software can ripple across supply chains and economies.”

- “We are actively working with customers and partners to ensure systems are secured,” Dassault Systèmes said in a statement. “Patches and mitigations have been released, and we strongly recommend immediate updates.”

Technical Analysis

The flaw resides in Apriso’s authentication module. Improper input validation in login requests allows attackers to bypass session verification, enabling arbitrary code execution with administrative privileges. Successful exploitation could:

- Access or modify production databases.

- Inject malicious instructions into factory automation workflows.

- Escalate attacks into connected ERP and PLM systems.

Mitigations include applying vendor patches, segmenting Apriso servers from external networks, enforcing MFA on supporting infrastructure, and monitoring for abnormal authentication attempts.

Impact & Response

Organizations in automotive, aerospace, and logistics sectors are particularly exposed. Exploited at scale, the vulnerability could cause production delays, supply chain disruptions, and theft of intellectual property. Security teams are advised to scan their environments, apply updates, and coordinate incident response planning.

Background

This disclosure follows a string of high-severity flaws in industrial and operational technology (OT) software, including vulnerabilities in Siemens’ TIA Portal and Rockwell Automation controllers. Experts warn that adversaries—ranging from ransomware gangs to state-sponsored groups—are increasingly focusing on OT targets due to their high-value disruption potential.

Conclusion

The CVE-2025-5086 flaw underscores the urgency for manufacturers to prioritize cybersecurity in factory software. As digital transformation accelerates, securing industrial platforms like Apriso will be critical to ensuring business continuity and protecting global supply chains.