data breaches

Global Crackdown on LockBit Ransomware: Arrests, Server Seizures, and Financial Sanctions

In a sweeping international effort to dismantle one of the most notorious ransomware gangs in the world, law enforcement agencies across multiple countries have dealt a severe blow to the LockBit ransomware syndicate. The unprecedented action included arrests, server seizures, and significant financial sanctions, marking a major milestone in the global fight against ransomware.

LockBit’s Reign of Cyber Terror

LockBit has become one of the most prominent ransomware groups in the world, responsible for a string of high-profile cyberattacks that have victimized organizations across numerous sectors—including healthcare, financial services, and critical infrastructure. Since its emergence in 2019, LockBit has been linked to hundreds of ransomware incidents that resulted in millions of dollars in damages. Its operations have stretched across continents, affecting victims in the United States, Europe, and Asia.

The group operates on a Ransomware-as-a-Service (RaaS) model, where core developers create the ransomware and rent it out to affiliates in exchange for a cut of the profits. Affiliates have targeted organizations indiscriminately, exploiting security vulnerabilities to gain access to networks, encrypt data, and demand ransom payments—often denominated in cryptocurrency—to unlock it.

LockBit has earned a particularly nefarious reputation for its ruthlessness in dealing with victims. Refusing to pay the ransom often results in the stolen data being leaked on the dark web. As their attacks have grown in frequency and impact, governments around the world have been working behind the scenes to dismantle this criminal enterprise, culminating in the recent global operation.

International Operation Leads to Arrests

The coordinated crackdown involved law enforcement from the United States, the United Kingdom, Germany, France, Japan, and several other nations, along with international agencies like Interpol and Europol. In an operation that took several months of planning, numerous members of the LockBit gang were arrested, including some high-profile individuals believed to be core developers and key operatives.

In a dramatic raid conducted in Dubai, a primary suspect—an individual identified as a critical operator for LockBit—was apprehended. Known for negotiating ransoms with victims, this suspect has been involved in laundering money from the proceeds of ransomware attacks. He is believed to have used an extensive network of cryptocurrency accounts and shell companies to help obscure the origins of funds, making it more difficult for authorities to track.

Additional arrests took place in Eastern Europe, where a collaborative effort among local and international authorities led to the detention of several affiliates who worked with the LockBit gang. These arrests are expected to provide significant insight into the gang’s inner workings, including how it recruited affiliates and executed its attacks. The individuals arrested have been implicated in attacks that crippled major hospitals, local governments, and private businesses—leading to millions of dollars in damages and untold disruptions.

Server Seizures Disrupt the Ransomware Infrastructure

In tandem with the arrests, law enforcement agencies successfully seized several servers operated by LockBit. These servers were central to the group’s operations, serving as the primary platforms for hosting stolen data, managing ransom payments, and conducting negotiations. With the seizure of these critical pieces of infrastructure, LockBit’s ability to operate has been severely impaired.

Authorities revealed that they had been tracking these servers for months, gathering evidence and waiting for the right moment to strike. The locations of the servers spanned multiple countries, including some that have been known as safe havens for cybercriminal activities. This made international cooperation and information sharing key to the successful dismantling of these systems.

The servers held troves of encrypted data belonging to past victims, some of which had refused to pay the ransom and had been in a state of uncertainty about whether their sensitive information would be leaked. By taking these servers offline, law enforcement has prevented further exploitation of this data, potentially saving victims from catastrophic consequences. The shutdown also means that ongoing negotiations and attempts to receive payment from victims have been abruptly halted.

Financial Sanctions Target the Money Flow

One of the biggest components of the crackdown was financial in nature. Authorities in the United States and allied countries imposed stringent financial sanctions targeting individuals, shell companies, and cryptocurrency wallets associated with LockBit’s activities. These sanctions are aimed at cutting off the funding streams that have fueled the gang’s operations.

The U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) identified numerous cryptocurrency wallets that were directly linked to ransomware payments made to LockBit. The wallets were frozen, rendering millions of dollars inaccessible to the gang. This financial disruption is seen as crucial because ransomware operations like those of LockBit rely heavily on the availability of funds to maintain their infrastructure, pay affiliates, and fund other aspects of their criminal operations.

In addition to freezing wallets, financial sanctions were imposed on exchange platforms that were found to be complicit in allowing LockBit to launder their funds. These exchanges were identified as having inadequate anti-money laundering measures in place, allowing LockBit to convert cryptocurrency ransom payments into fiat money with relative ease.

The Role of Private Sector and Public-Private Partnerships

This operation underscores the importance of public-private partnerships in the fight against ransomware. A number of cybersecurity firms played pivotal roles in this crackdown, working closely with law enforcement agencies to share intelligence about LockBit’s operations. These firms provided critical insights into the ransomware’s behavior, identified infrastructure components, and analyzed cryptocurrency transactions that led to the identification of key figures within the organization.

Cybersecurity companies have also been instrumental in helping victims recover from attacks without paying ransoms, thereby reducing the profitability of these schemes. By making decryption tools available and advising companies on better cyber defense measures, the private sector has become an essential ally in the fight against cybercrime.

Impact on LockBit and the Broader Ransomware Ecosystem

The crackdown on LockBit is a significant blow to the global ransomware ecosystem. LockBit has been one of the leading RaaS providers, with a network of affiliates responsible for hundreds of attacks around the world. By targeting their infrastructure, leadership, and financial channels, authorities have effectively weakened their ability to carry out future attacks.

However, cybersecurity experts caution that this is far from the end of the ransomware threat. The ransomware ecosystem is highly adaptable and decentralized, meaning that other groups or even splinter factions from LockBit could step in to fill the void. Criminals will likely modify their tactics and seek new ways to evade detection and continue their illicit operations.

Implications for Ransomware Policy and International Cybersecurity

The success of this crackdown highlights the importance of international cooperation in dealing with cyber threats that transcend borders. Countries that were previously criticized for not doing enough to combat cybercriminals operating within their territories have demonstrated a willingness to participate in coordinated efforts, acknowledging that the threat of ransomware is a global problem that requires a collective response.

The operation also reinforces the need for stringent regulations in the cryptocurrency space, as ransomware groups have leveraged the relative anonymity of digital currencies to evade law enforcement. Governments are now calling for enhanced regulations that would require exchanges to implement more robust anti-money laundering (AML) and know-your-customer (KYC) procedures.

Moreover, the crackdown is a signal to other ransomware groups that their activities will not go unchallenged. It represents an important shift toward a more aggressive stance against cybercrime, moving beyond defensive measures and actively dismantling the infrastructure used by cybercriminals.

The Way Forward

The takedown of LockBit has provided a momentary reprieve for organizations worldwide, but it also serves as a reminder of the importance of maintaining strong cybersecurity defenses. Companies and institutions must remain vigilant, continuing to invest in cybersecurity measures, conduct employee training, and develop incident response plans to mitigate the impact of ransomware attacks.

For governments, this crackdown represents a blueprint for future operations. By combining arrests, infrastructure takedowns, and financial sanctions, law enforcement has shown that a comprehensive, multi-faceted approach can yield results. The key moving forward will be sustaining this level of international cooperation and maintaining pressure on cybercriminals, ensuring they have fewer places to hide.

The global crackdown on LockBit is a major victory in the battle against ransomware, demonstrating that these groups are not untouchable. While the fight against ransomware is far from over, this operation represents a critical step toward making cyberspace a safer environment for all.

data breaches

Cloudflare Outage Disrupts Global Internet — Company Restores Services After Major Traffic Spike

November 18, 2025 — MAG212NEWS

A significant outage at Cloudflare, one of the world’s leading internet infrastructure providers, caused widespread disruptions across major websites and online services on Tuesday. The incident, which began mid-morning GMT, temporarily affected access to platforms including ChatGPT, X (formerly Twitter), and numerous business, government, and educational services that rely on Cloudflare’s network.

According to Cloudflare, the outage was triggered by a sudden spike in “unusual traffic” flowing into one of its core services. The surge caused internal components to return 500-series error messages, leaving users unable to access services across regions in Europe, the Middle East, Asia, and North America.

Impact Across the Web

Because Cloudflare provides DNS, CDN, DDoS mitigation, and security services for millions of domains — powering an estimated 20% of global web traffic — the outage had swift and wide-reaching effects.

Users reported:

- Website loading failures

- “Internal Server Error” and “Bad Gateway” messages

- Slowdowns on major social platforms

- Inaccessibility of online tools, APIs, and third-party authentication services

The outage also briefly disrupted Cloudflare’s own customer-support portal, highlighting the interconnected nature of the company’s service ecosystem.

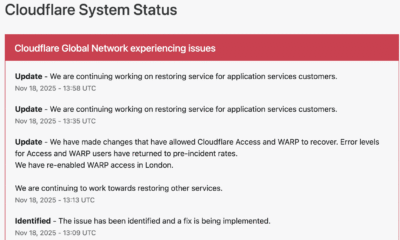

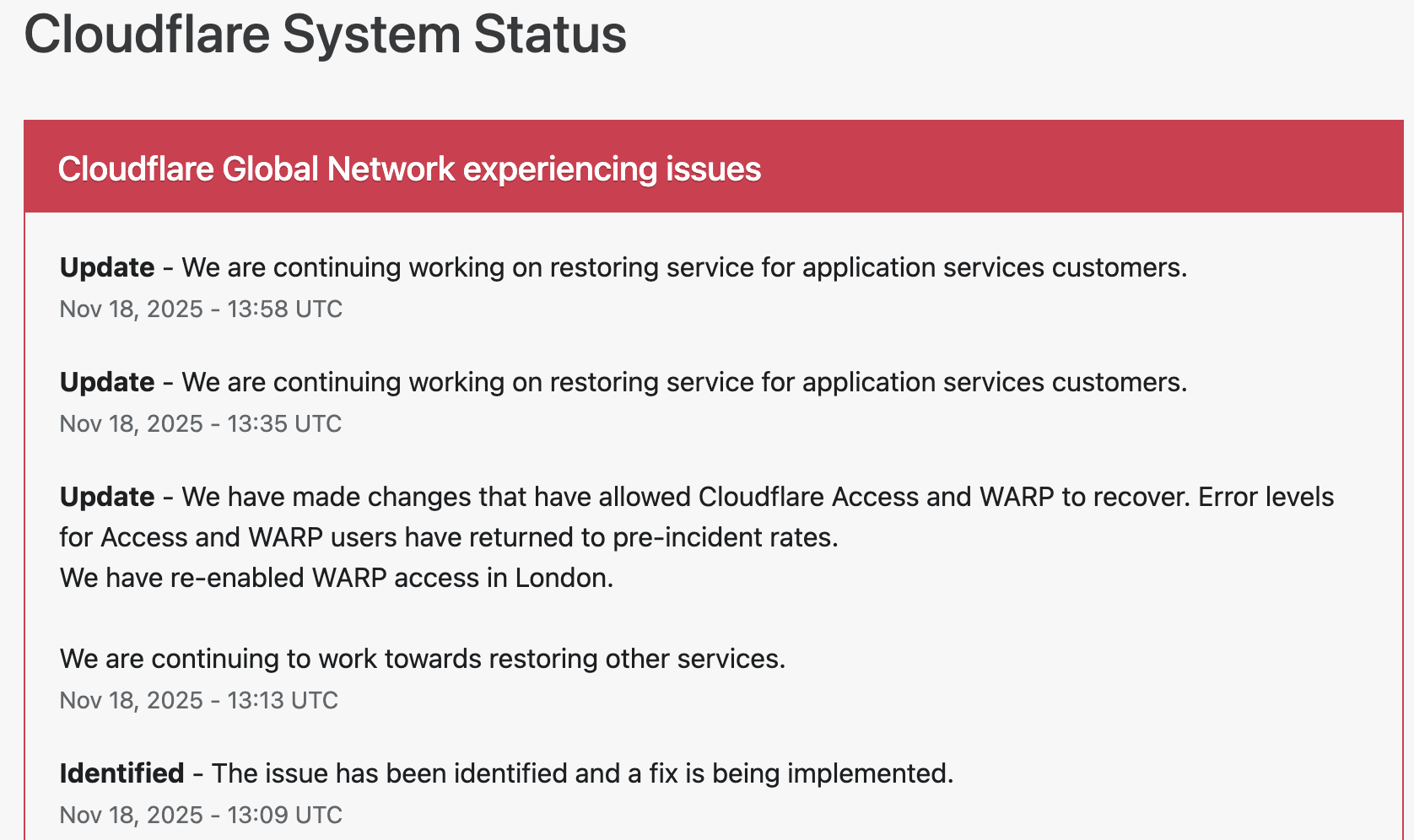

Cloudflare’s Response and Restoration

Cloudflare responded within minutes, publishing updates on its official status page and confirming that engineering teams were investigating the anomaly.

The company took the following steps to restore operations:

1. Rapid Detection and Acknowledgement

Cloudflare engineers identified elevated error rates tied to an internal service degradation. Public communications were issued to confirm the outage and reassure customers.

2. Isolating the Affected Systems

To contain the disruption, Cloudflare temporarily disabled or modified specific services in impacted regions. Notably, the company deactivated its WARP secure-connection service for users in London to stabilize network behavior while the fix was deployed.

3. Implementing Targeted Fixes

Technical teams rolled out configuration changes to Cloudflare Access and WARP, which successfully reduced error rates and restored normal traffic flow. Services were gradually re-enabled once systems were verified stable.

4. Ongoing Root-Cause Investigation

While the unusual-traffic spike remains the confirmed trigger, Cloudflare stated that a full internal analysis is underway to determine the exact source and prevent a recurrence.

By early afternoon UTC, Cloudflare confirmed that systems had returned to pre-incident performance levels, and affected services worldwide began functioning normally.

Why This Matters

Tuesday’s outage underscores a critical truth about modern internet architecture: a handful of infrastructure companies underpin a massive portion of global online activity. When one of them experiences instability — even briefly — the ripple effects are immediate and worldwide.

For businesses, schools, governments, and content creators, the incident is a reminder of the importance of:

- Redundant DNS/CDN providers

- Disaster-recovery and failover plans

- Clear communication protocols during service outages

- Vendor-dependency risk assessments

Cloudflare emphasized that no evidence currently points to a cyberattack, though the nature of the traffic spike remains under investigation.

Looking Ahead

As Cloudflare completes its post-incident review, the company is expected to provide a detailed breakdown of the technical root cause and outline steps to harden its infrastructure. Given Cloudflare’s central role in global internet stability, analysts say the findings will be watched closely by governments, cybersecurity professionals, and enterprise clients.

For now, services are restored — but the outage serves as a powerful reminder of how interconnected and vulnerable the global web can be.

data breaches

Cloudflare Outage Analysis: Systemic Failure in Edge Challenge Mechanism Halts Global Traffic

SAN FRANCISCO, CA — A widespread disruption across major internet services, including AI platform ChatGPT and social media giant X (formerly Twitter), has drawn critical attention to the stability of core internet infrastructure. The cause traces back to a major service degradation at Cloudflare, the dominant content delivery network (CDN) and DDoS mitigation provider. Users attempting to access affected sites were met with an opaque, yet telling, error message: “Please unblock challenges.cloudflare.com to proceed.”

This incident was not a simple server crash but a systemic failure within the crucial Web Application Firewall (WAF) and bot management pipeline, resulting in a cascade of HTTP 5xx errors that effectively severed client-server connections for legitimate users.

The Mechanism of Failure: challenges.cloudflare.com

The error message observed globally points directly to a malfunction in Cloudflare’s automated challenge system. The subdomain challenges.cloudflare.com is central to the company’s security and bot defense strategy, acting as an intermediate validation step for traffic suspected of being malicious (bots, scrapers, or DDoS attacks).

This validation typically involves:

- Browser Integrity Check (BIC): A non-invasive test ensuring the client browser is legitimate.

- Managed Challenge: A dynamic, non-interactive proof-of-work check.

- Interactive Challenge (CAPTCHA): A final, user-facing verification mechanism.

In a healthy system, a user passing through Cloudflare’s edge network is either immediately granted access or temporarily routed to this challenge page for verification.

During the outage, however, the Challenge Logic itself appears to have failed at the edge of Cloudflare’s network. When the system was invoked (likely due to high load or a misconfiguration), the expected security response—a functional challenge page—returned an internal server error (a 500-level status code). This meant:

- The Request Loop: Legitimate traffic was correctly flagged for a challenge, but the server hosting the challenge mechanism failed to process or render the page correctly.

- The

HTTP 500Cascade: Instead of displaying the challenge, the Cloudflare edge server returned a “500 Internal Server Error” to the client, sometimes obfuscated by the text prompt to “unblock” the challenges domain. This effectively created a dead end, blocking authenticated users from proceeding to the origin server (e.g., OpenAI’s backend for ChatGPT).

Technical Impact on Global Services

The fallout underscored the concentration risk inherent in modern web architecture. As a reverse proxy, Cloudflare sits between the end-user and the origin server for a vast percentage of the internet.

For services like ChatGPT, which rely heavily on fast, secure, and authenticated API calls and constant data exchange, the WAF failure introduced severe latency and outright connection refusal. A failure in Cloudflare’s global network meant that fundamental features such as DNS resolution, TLS termination, and request routing were compromised, leading to:

- API Timeouts: Applications utilizing Cloudflare’s API for configuration or deployment experienced critical failures.

- Widespread Service Degradation: The systemic 5xx errors at the L7 (Application Layer) caused services to appear “down,” even if the underlying compute resources and databases of the origin servers remained fully operational.

Cloudflare’s official status updates confirmed they were investigating an issue impacting “multiple customers: Widespread 500 errors, Cloudflare Dashboard and API also failing.” While the exact trigger was later traced to an internal platform issue (in some historical Cloudflare incidents, this has been a BGP routing error or a misconfigured firewall rule pushed globally), the user-facing symptom highlighted the fragility of relying on a single third-party for security and content delivery on a global scale.

Mitigation and the Single Point of Failure

While Cloudflare teams worked to roll back configuration changes and isolate the fault domain, the incident renews discussion on the “single point of failure” doctrine. When a critical intermediary layer—responsible for security, routing, and caching—experiences a core logic failure, the entire digital economy resting on it is exposed.

Engineers and site reliability teams are now expected to further scrutinize multi-CDN and multi-cloud strategies, ensuring that critical application traffic paths are not entirely dependent on a single third-party’s edge infrastructure, a practice often challenging due to cost and operational complexity. The “unblock challenges” error serves as a stark reminder of the technical chasm between a user’s browser and the complex, interconnected security apparatus that underpins the modern web.

data breaches

Manufacturing Software at Risk from CVE-2025-5086 Exploit

Dassault Systèmes patches severe vulnerability in Apriso manufacturing software that could let attackers bypass authentication and compromise factories worldwide.

A newly disclosed flaw, tracked as CVE-2025-5086, poses a major security risk to manufacturers using Dassault Systèmes’ DELMIA Apriso platform. The bug could allow unauthenticated attackers to seize control of production environments, prompting urgent patching from the vendor and warnings from cybersecurity experts.

A critical vulnerability in DELMIA Apriso, a manufacturing execution system used by global industries, could let hackers bypass authentication and gain full access to sensitive production data, according to a security advisory published this week.

Dassault Systèmes confirmed the flaw, designated CVE-2025-5086, affects multiple versions of Apriso and scored 9.8 on the CVSS scale, placing it in the “critical” category. Researchers said the issue stems from improper authentication handling that allows remote attackers to execute privileged actions without valid credentials.

The company has released security updates and urged immediate deployment, warning that unpatched systems could become prime targets for industrial espionage or sabotage. The flaw is particularly alarming because Apriso integrates with enterprise resource planning (ERP), supply chain, and industrial control systems, giving attackers a potential foothold in critical infrastructure.

- “This is the kind of vulnerability that keeps CISOs awake at night,” said Maria Lopez, industrial cybersecurity analyst at Kaspersky ICS CERT. “If exploited, it could shut down production lines or manipulate output, creating enormous financial and safety risks.”

- “Manufacturing software has historically lagged behind IT security practices, making these flaws highly attractive to threat actors,” noted James Patel, senior researcher at SANS Institute.

- El Mostafa Ouchen, cybersecurity author, told MAG212News: “This case shows why manufacturing execution systems must adopt zero-trust principles. Attackers know that compromising production software can ripple across supply chains and economies.”

- “We are actively working with customers and partners to ensure systems are secured,” Dassault Systèmes said in a statement. “Patches and mitigations have been released, and we strongly recommend immediate updates.”

Technical Analysis

The flaw resides in Apriso’s authentication module. Improper input validation in login requests allows attackers to bypass session verification, enabling arbitrary code execution with administrative privileges. Successful exploitation could:

- Access or modify production databases.

- Inject malicious instructions into factory automation workflows.

- Escalate attacks into connected ERP and PLM systems.

Mitigations include applying vendor patches, segmenting Apriso servers from external networks, enforcing MFA on supporting infrastructure, and monitoring for abnormal authentication attempts.

Impact & Response

Organizations in automotive, aerospace, and logistics sectors are particularly exposed. Exploited at scale, the vulnerability could cause production delays, supply chain disruptions, and theft of intellectual property. Security teams are advised to scan their environments, apply updates, and coordinate incident response planning.

Background

This disclosure follows a string of high-severity flaws in industrial and operational technology (OT) software, including vulnerabilities in Siemens’ TIA Portal and Rockwell Automation controllers. Experts warn that adversaries—ranging from ransomware gangs to state-sponsored groups—are increasingly focusing on OT targets due to their high-value disruption potential.

Conclusion

The CVE-2025-5086 flaw underscores the urgency for manufacturers to prioritize cybersecurity in factory software. As digital transformation accelerates, securing industrial platforms like Apriso will be critical to ensuring business continuity and protecting global supply chains.